6 Simple and Effective Tips for Pricing with Confidence

Pricing your services isn’t just about picking a number and running with it. It’s a blend of art and science and most importantly, it’s about knowing your numbers and the value you bring. If you’ve ever struggled with pricing confidently or felt stuck between attracting clients and charging what you’re truly worth, this guide is for you.

New Here?

I’m Amelia, a Toronto-based accountant dedicated to supporting women-owned businesses. My main purpose is to help you know your numbers, increase profits, and avoid mistakes when it comes to the numbers side of your biz.

Whether it’s taking it off your plate, helping you DIY with ease with my Sole Prop Starter Kit, or increasing your financial awareness—I’m here to make it simple.

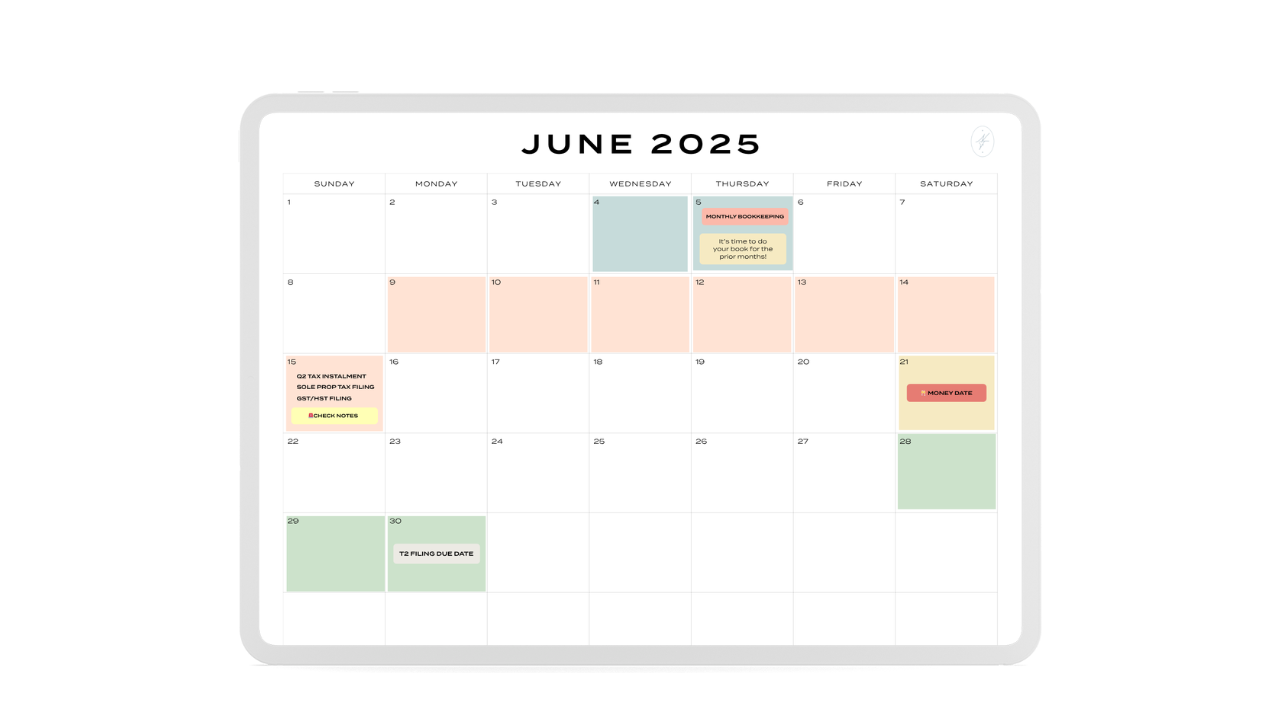

Be sure to sign up for free monthly bookkeeping & tax reminders sent straight to your inbox to be sure you stay on track and never miss a deadline.

Let’s Get Into My Top 6 Tips On Pricing With Confidence

1. Value Mindset Shift

First things first: You’re not setting your prices based on how much time it takes to do the work. Instead, you’re pricing based on the value and transformation you provide. While this may seem like a small distinction, it’s a game-changer in how clients perceive you and how you position yourself in your business.

When pricing by time, we can get caught up in focusing on hours instead of outcomes. While hours are measurable, what clients truly care about is the transformation you bring. For example, if your services save them time, reduce their stress, or help increase their revenue, that impact should be a major factor in your pricing.

Your pricing strategy is key to your business’s success. It’s not about being the cheapest option; it’s about being the smartest choice.

2. Review the Industry Standards

Before I dive deeper into this, just a quick reminder: Don’t base your decisions solely on what others are charging.**This is your business, and you need to approach it in a way that works for you. Consider things like your experience, the level of care you provide, and how efficient your systems are when determining your pricing.

Ultimately, industry standards are just a guide, not a rule.

Analyze your competitors: What are others in your niche charging? Are they offering premium services, more affordable options, or something in between?

Highlight your unique value: What makes your service stand out? If you bring something extra to the table, whether it's a tailored approach, specialized skills, or additional support, your pricing should reflect that.

Consider your ideal client’s budget: Who are you trying to serve? Are they used to paying for high-end services or are they more price-sensitive? Pricing that aligns with your audience’s expectations will attract the clients who truly value your offerings.

3. Decode Your Expenses

Let’s get into the nitty-gritty of pricing by breaking down the financial components that make it all come together.

Understand Your Costs (Direct and Indirect)

To price sustainably, you need to have a full picture of your costs. It’s easy to focus only on direct expenses, but indirect costs can sneak up on you and eat into your profits.

Direct Costs: These are the clear, immediate expenses tied to delivering your service.

-

Materials and tools: Whether it's specialized software, supplies, or other materials you need, these add up.

-

Your time: Even though you're not charging hourly, your time is still limited and needs to be factored in.

-

Contractors or team members: If you bring in extra help, their costs should be included too.

-

Software subscriptions: Any ongoing tools you rely on for design, project management, or client communication.

-

Travel or platform fees: If travel or platform fees are part of your work, don’t forget to include them.

Indirect Costs: These are the behind-the-scenes expenses that often get overlooked.

-

Admin time: Time spent on tasks like invoicing, scheduling, or handling client questions.

-

Marketing and advertising: Ads, social media management, or email tools—anything you invest in to keep the clients coming.

-

Ongoing education and training: If you're investing in learning new skills or staying up-to-date, this should be reflected in your pricing.

-

Office supplies and technology: Computers, software, or other essentials to keep your business running.

-

Taxes: Don’t forget to account for taxes. Setting aside funds early can save you a lot of stress later on.

4. Analyze Your Profit

Once you’ve calculated your expenses, the next step is to add a profit margin. A solid starting point is aiming for a 20-30% margin after covering all your costs. For instance, if you choose a 30% margin and your total expenses are $1,000, you’d add $300 for profit, bringing your service price to $1,300.

This margin is just a starting point. As your business evolves, you can adjust it based on your goals, market trends, and any changes in your business.

5. Looking At the Big Picture

Your pricing should work in harmony with your overall business strategy. Here's how to make sure your pricing aligns with your bigger goals:

Establish your income target: Begin by deciding how much you want to pay yourself month, then set your pricing to help you achieve that.

Factor in all costs: Don't just cover expenses. Make sure you're pricing to make a profit and account for taxes.

Prioritize high-revenue services: Focus on what brings in the most revenue, and plan how to balance these offerings for maximum impact.

Set realistic sales targets: Let your pricing guide you in determining how many clients you need to meet your income goals.

6. Avoid these Pricing Mistakes

Pricing can be tricky, especially when you’re just starting. Here are a few mistakes you’ll want to avoid:

Undervaluing Your Time and Skills: Your experience and expertise have value—don’t sell yourself short. Clients are paying for the knowledge and insights you bring to the table.

Vague Scope: Loose agreements can lead to stress and frustration down the line. Be clear about what’s included in your contract and set boundaries by adding a clause for anything outside the scope.

Forgetting to Adjust for Seasonal Changes: As your business grows, so do your costs and client needs. Make it a point to revisit your pricing every few months to keep it in line with changes in the market.

What’s next?

If pricing feels overwhelming, don’t stress you are not alone. At Nouvelle Financial, we’re here to help women entrepreneurs like you turn their numbers into a powerful strategic tool. Click here to schedule a complimentary connection call, and let’s create a strategy that makes your pricing work for you!