Salary vs. Dividends: What's the Best Way to Pay Yourself?

Let’s talk about getting paid - because as a business owner, how you pay yourself matters. Salary and dividends are the two main options, and each comes with its own set of perks and drawbacks. Picking the right approach can make a big difference in your tax bill, retirement savings, and ability to get a mortgage.

If you’ve ever wondered, Should I take a salary? What about dividends? You’re in the right place.

Let’s break it down.

New here?

I’m Amelia, a Toronto-based accountant dedicated to supporting women-owned businesses. My main purpose is to help you know your numbers, increase profits, and avoid mistakes when it comes to the numbers side of your biz.

Whether it’s taking it off your plate, helping you DIY with ease with our Sole Prop Starter Kit, or increasing your financial awareness—I’m here to make it simple.

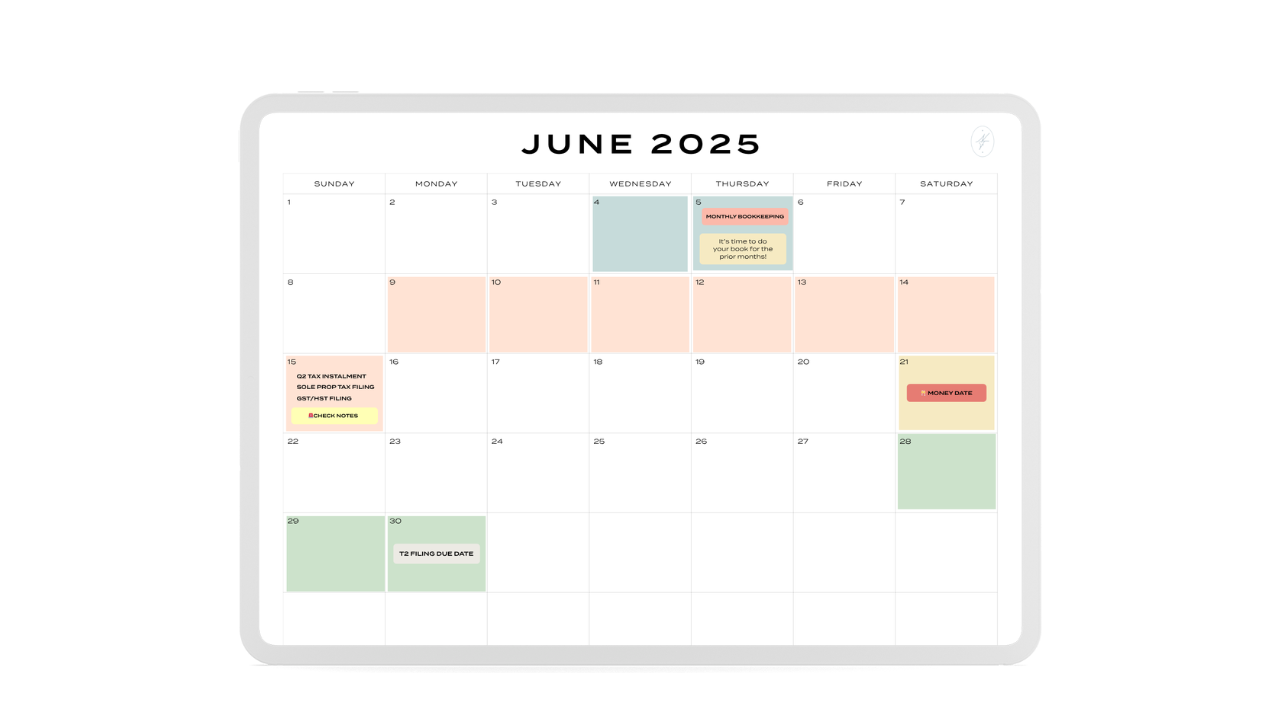

Be sure to sign up for free monthly bookkeeping & tax reminders sent straight to your inbox to be sure you stay on track and never miss a deadline.

Salary Breakdown

A salary means your business pays you just like an employee—regular paychecks, tax deductions, and all. Here’s what you need to know:

Lowers Your Corporate Taxes – Your salary is a tax-deductible expense for your business, which means your corporation pays less in taxes.

Health Spending Account (HSA) Perks – With a salary, you qualify for a Health Spending Account (HSA), one of the best ways to turn medical expenses into a tax-saving advantage.

RRSP Contribution Room – A salary creates Registered Retirement Savings Plan (RRSP) room, so you can invest tax-free for your future.

CPP Benefits in Retirement – Contributing to the Canada Pension Plan (CPP) now means receiving benefits later. It’s forced retirement savings, but in a good way.

Easier Loan & Mortgage Approvals – Banks love steady income. A salary makes it much easier to qualify for a mortgage, car loan, or rental application.

Home Buyers’ Plan (HBP) Eligibility – If you’re saving for a home, a salary helps you qualify to withdraw up to $60,000 from your RRSP tax-free for a down payment.

⚠ More Admin Work – Payroll means regular tax remittances and deductions, but that’s what accountants (like me!) are here for.

Dividends Breakdown

Flexible & Low Maintenance – Dividends allow you to take money from your business without the complexity of payroll. It's a straightforward option, but it's not without its downsides.

⚠ Higher Tax Bill at Year-End – Unlike salary, dividends aren’t taxed at the source. That means no tax is withheld when you take money out, so you need to set money aside for taxes or risk a hefty bill come tax season.

Less Administrative Work – No payroll deductions, no monthly remittances - just a T5 slip filed at year-end. Easy!

Not a Tax Deduction – Unlike a salary, dividends don’t reduce your corporate taxable income, meaning your company could owe more tax.

No RRSP Contribution Room – RRSP room is based on earned income, and dividends don’t count, so you’ll miss out on this tax-saving opportunity.

No CPP Contributions = No CPP Benefits – Opting for dividends means no CPP deductions now but also no CPP payouts in retirement.

Not Eligible for the Home Buyers’ Plan or an HSA – If homeownership or tax-efficient medical coverage is a goal, dividends won’t help you qualify.

So… Which one should you choose?

It depends on your goals! Here’s a quick guide:

Want predictable income & retirement savings? → Salary.

Need to qualify for a mortgage or loan? → Salary.

Prefer a simple, low-maintenance approach? → Dividends.

Want to reduce corporate taxes? → Salary.

What’s next?

For most business owners, the sweet spot is a mix of both. Taking a reasonable salary to cover essentials (like RRSP contributions and loan approvals) while using dividends for flexibility.

The key? Strategic planning. That’s where I come in! As an accountant who specializes in working with business owners, I’ll help you create a pay structure that minimizes taxes, maximizes savings, and supports your financial goals.

Let’s chat! Click here to book a connection call today, and let’s make sure your money is working for you and not the other way around.